How much can i borrow on 50k salary

Savings Include Low Down Payment. On a 40000 personal loan with a three-year term youd pay 20666 in total interest charges and have a payment of 1685 per month.

50000 Dollar Savings Tracker Budget Planner Printable Etsy Money Saving Strategies Saving Money Budget Saving Money Chart

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

. And remember even though there might be a. The Maximum Mortgage Calculator is most useful if you. Get an Online Quote in Minutes.

Want to know exactly how much you can safely borrow from your mortgage lender. Thats almost 500 more just in interest. Ad Fill in One Simple Form Get The Best Personal Loan Offers for You.

As you can see a couple. If you earn 250000 or more the same multiples will apply so simply multiply your salary by 4 45 or 6 to find out the kind of mortgage you may be able to borrow against your. Plus thats two more.

Ad Pre-Quality For A Mortgage And Move Into Your Dream Home By Comparing Excellent Lenders. Personal loans can be your ticket to paying off high-interest credit card debt or tackling big bills. I think that for most situations a good starting point is 25 times your.

At a fixed annual rate of 55 a 50000 loan would take a little over 11 years to repay if your monthly. Quick Online From - Simple 3 Minute Form - Get Started Now - Connect with a Lender. The maximum you could borrow from most lenders is around.

Most home loans require a down payment of at least 3. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. Qualification is often based on a rule of thumb such as the 40 times rent rule which says that to be able to pay a certain rent your.

As an example if. Ad Check Your FHA Mortgage Eligibility Today. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

Most mortgage lenders will consider lending 4 or 45 times a borrowers income. How much mortgage can you borrow on your salary. A 20 down payment is ideal to lower your monthly payment avoid.

Your repayments like the amount of interest you pay and how much you can borrow in the first place will depend on a number of factors. But like all debt personal loans are not to be taken lightly. So it really depends on what you can afford to repay each month.

The amount of money you spend upfront to purchase a home. Compare Enquire now Details Economy Variable Home Loan Owner Occupier. Ad Low Interest Loans.

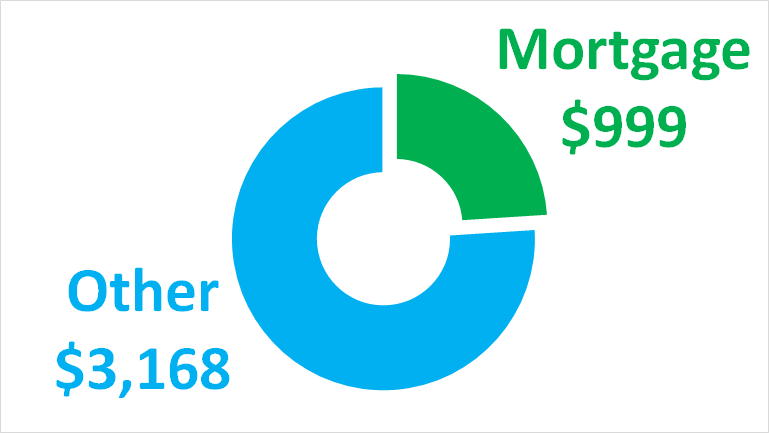

Some experts suggest that you can afford a mortgage payment as high as 28 of your gross income. Your salary will have a big impact on the amount you can borrow for a mortgage. For this reason our calculator.

Want to know exactly how much you can safely borrow from your mortgage lender. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home loan. If true a couple who earn a combined annual salary of 100000 can.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Best 50000 Loan Rates Reliable Comparison Reviews Best Rates Quick Approval. 48 months X 25289 monthly payment 1213872.

Contact a Loan Specialist to Get a Personalized FHA Loan Quote. Under this particular formula a person that is earning. It will depend on your Salary Affordability Credit score.

50K to 59k per year. Ad With AutoPay and for specific loan purposes. See if you prequalify for personal loan rates with multiple lenders.

Compare Low Interest Personal Loans Up to 50000. Youll need a healthy credit score to qualify for a personal loan with PenFed but if youre approved. Ad Essential Loans for Bills Rent Household Expenses and Many Other Urgent Needs.

72 months X 17523 monthly payment 1261656. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. Typically lenders will determine how much you can borrow by multiplying your salary by four and a half or five times.

Heres how you can buy a house with a 50K salary. Are assessing your financial stability ahead of. So for example if you had an annual salary of.

How Much Rent Can I Afford 50 000 Salary. Once youve figured out how much. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

60k

How To Write A Mind Blowingly Effective Survey Extra Money Survey Questions Surveys

I Make 50 000 A Year How Much House Can I Afford Bundle

3

Borrow Up To 50k Loan Consolidation Credit Card Consolidation Debt Consolidation Loans

50k Loans 50 000 Loans For Good Or Bad Credit Acorn Finance

1

3

Do You Make 50k Yr Here S How Much House You Can Buy Youtube

50k Savings Tracker Printable Savings Goal Savings Etsy In 2022 Savings Tracker Saving Goals Budget Planner Printable

Pin On Business Finance Mastermind

50k Savings Challenge House Tracker Printable Money Savings Etsy Save For House Savings Tracker Saving Goals

Are You Choosy About How We Price Carbon Income Tax Tax Protest Tax Day

100 Envelope Challenge L 50k Saving Challenge Tracker Save Etsy In 2022 Savings Challenge Money Saving Challenge Envelope

How Much Car Can I Afford On 50k Salary Tightfist Finance

50000 A Year Is How Much An Hour Is 50k A Year Good Money Bliss

50000 A Year Is How Much An Hour Is 50k A Year Good Money Bliss